Sunday, September 11, 2011

French Banks Poised for Moody’s Downgrade

Moody’s placed the three banks’ ratings on review in June to examine “the potential for inconsistency between the impact of a possible Greek default or restructuring and current rating levels,” the rating company said at the time. Cuts are expected next week as the review period concludes, said the people, who declined to be identified because the matter is confidential.

Group of Seven finance chiefs vowed yesterday to support banks and buoy slowing economic growth as Europe’s debt crisis roiled financial markets and threatened a global recession. Renewed fears that European policy makers are failing to prevent a Greek default and contain their debt woes yesterday prompted investors to sell stocks and push the euro to a six-month low against the dollar. European bank and sovereign credit risk reached all-time highs as 10-year Treasury and German bund yields fell to record lows on demand for a haven.

“We will take all necessary actions to ensure the resilience of banking systems and financial markets,” G-7 finance ministers and central bankers said in a statement released during talks in Marseille, France late yesterday.

Moody’s currently rates BNP Paribas’ long-term debt at Aa2, the third-highest investment grade. Credit Agricole is rated Aa1, the second highest, while Societe Generale (GLE) is Aa2.

Stocks Decline

Credit Agricole spokeswoman Anne-Sophie Gentil declined to comment, as did BNP Paribas spokesman Antoine Sire. Societe Generale spokeswoman Laetitia Maurel said she couldn’t immediately comment. Voicemail messages left on the mobile and office lines of Moody’s chief European spokesman Daniel Piels today, outside of working hours, weren’t immediately answered.

Societe Generale has dropped 55 percent in Paris trading since June 15, while Credit Agricole tumbled 45 percent and BNP Paribas has declined 42 percent. The Bloomberg Europe Banks and Financial Services Index of 46 companies fell 30 percent in the same period.

The reviews of Credit Agricole and BNP Paribas are unlikely to lead to downgrades of more than one level, Moody’s said when it put the banks under review. Societe Generale’s debt and deposit ratings may be cut as much as two grades because of the “uplift it receives from systemic support, which is currently higher than average for the French banking system,” the rating company said at the time.

Credit Agricole’s main risk arises from its Greek subsidiary Emporiki Bank of Greece SA, which was downgraded earlier this month, Moody’s said in June. Societe Generale, France’s second-largest bank by market value, faces risks from its stake in General Bank of Greece. Credit Agricole is France’s third-largest bank. BNP Paribas doesn’t have a local unit in Greece and is instead at risk from direct holdings of Greek government debt, Moody’s said.

Tuesday, August 30, 2011

Stocks Surge as the Dollar Suffers Ahead of Key Data this Week

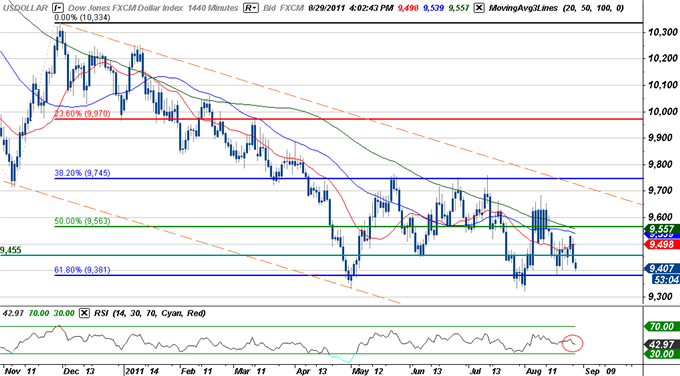

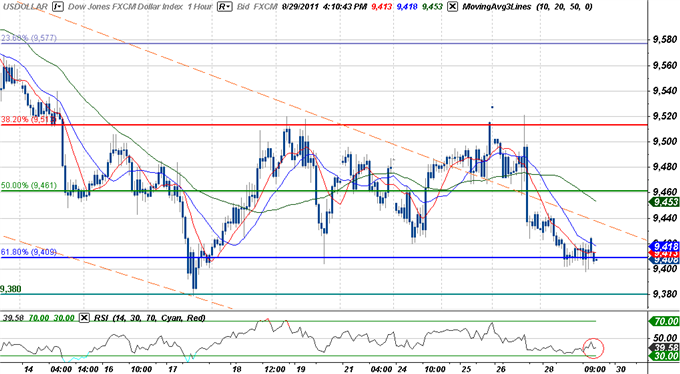

The greenback was lower at the close of North America trade with the Dow Jones FXCM Dollar Index (Ticker: US Dollar) falling 0.26% on the session. The losses come on the back of a substantial shift in risk appetite that saw US equities surge across the board with the Dow, the S&P, and NASDAQ advancing 2.26%, 2.83%, and 3.32% respectively. Stronger than expected personal spending figures in pre-market trade gave futures a lift with markets steadily advancing throughout the day to close at session highs. Trade volume remained thin however as many investors were on the sidelines after hurricane Irene ravaged the northeast seaboard over the weekend. The damages were less substantial than anticipated with the storm sparing New York City the worst of its wrath, adding fuel to today’s rally in risk

The greenback remained on the defensive with the index holding its recent range ahead of this week’s economic docket. The dollar sees increased risk for extended losses with a break below the key 61.8% long-term Fibonacci extension taken from the June 7th and November 30th 2010 crests at 9380. Price action will largely be determined by broader market sentiment as investors digest the implications of Bernanke’s remarks at Jackson Hole where he evaded talk of further Fed easing while hinting that the central bank remains poised to respond should the situation deteriorate.

The index continues to range between the key 61.8% and 38.2% Fibonacci extensions taken from the July 12th and August 8th crests at 9410 and 9515 respectively. As noted in last week’s USD Trading Today report, the greenback risks significant losses with a break below 9400 with subsequent floors seen at 9380 and the 76.4% extension at 9345. Topside resistance is eyed at 9440 backed by the 50% extension at 9460 and the 38.2% extension at 9515.

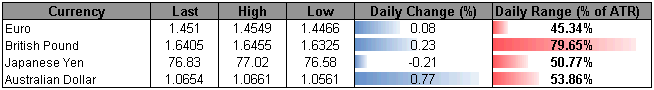

The dollar fell against all the component currencies save the yen which declined by 0.21% on the session. Highlighting the performance chart is a 0.77% advance in the Australian dollar which surged late in the day as traders jettisoned so called “safe haven” assets in favor of yields. For now, the aussie continues to boast the highest interest rate of the developed economies and accordingly it has been the primary beneficiary of today’s rally in risk.

Tomorrow’s economic docket is highlighted by the August consumer confidence report and the FOMC minutes from the August 9th meeting. Consensus estimates call for confidence to fall to 52.0, down from the previous read of 59.5, its second lowest print this year. Investors will be carefully combing the FOMC minutes for subtexts after the vote saw three dissenters early this month. And while the minutes are likely to reinforce Bernanke’s comments at Jackson Hole in omitting talk of another round of quantitative easing, the record may reveal a shift among voting members as inflation concerns are rekindled and begin to take root. Looming over trade this week are the August non-farm payroll figures on tap for Friday with estimates calling for yet another dismal print of just 75K, down from 117K the in July. Disappointing data tomorrow could weigh on the recent shift in risk sentiment to the benefit of the dollar as traders seek refuge in the reserve currency.

Sunday, July 24, 2011

China Yuan Hits Fresh High Late On 3rd Straight Record Fixing

Dealers said, however, that they expect the People's Bank of China to let the yuan consolidate next week after its rapid run-up in recent sessions.

On the over-the-counter market, the dollar was at CNY6.4455 around 0830 GMT, down from CNY6.4516 late Thursday. It traded between CNY6.4455, the lowest since China's landmark currency reforms in 2005, and CNY6.4486.

At CNY6.4455 to the dollar, the yuan has risen 5.9% against the U.S. unit since June, when China effectively ended its currency's two-year peg to the dollar. It is up 0.27% this week, compared with last month's 0.22% increase.

The People's Bank of China fixed the dollar/yuan central parity rate at an all-time low for the third straight session after the euro surged overnight on plans for a new Greek bailout and an overhaul of the euro zone's rescue fund, which assuaged fears about possible contagion. Friday's parity was fixed at 6.4495 from Thursday's 6.4536.

"I think the market is still in a watch-and-wait mode as the trading volume is low. The feeling is the yuan has risen a lot this week and it's unclear how much more gains the PBOC has in store for the currency," a Beijing-based local bank trader said.

Dealers said the yuan's fast-paced gains this week were also likely spurred on by the sixth anniversary of China's currency reforms on July 21, 2005, when China abandoned a decade-old peg against the dollar amid market and political pressure. The PBOC also revalued the yuan overnight by 2.1% to 8.11 against the dollar at the time.

"We can't rule out a possible widening of the dollar/yuan trading band around this time, given the anniversary, although I think there is no need to expand the band for now," said a Shanghai-based trader from a foreign bank.

The market has been suspecting that the central bank could soon widen the daily trading limit to 1% above or below the central parity from the current 0.5%.

Offshore, the yuan rose against the dollar in both the nondeliverable forwards and spot markets, tracking a stronger yuan onshore. One-year dollar-yuan nondeliverable forwards fell to 6.3780/6.3810 from 6.3870/6.3910 late Thursday, implying a 1.3% rise by the yuan against the U.S. currency over the next year.

In the offshore yuan market in Hong Kong, where the Chinese currency floats freely, the dollar-yuan exchange rate was at 6.4455 late Friday, down from 6.4495 late Thursday.

-By Jean Yung, Dow Jones Newswires; 8621 6120-1200; jean.yung@dowjones.com

Saturday, July 9, 2011

Thursday, June 30, 2011

10 Ways to Prepare for Ramadan

The Sahaaba used to prepare for Ramadan six months in advance. So if we really want to make the best of this Ramadan then we need to prepare for it now!

This may be our last Ramadan for life is so uncertain. Then there is NO doubt that we must make the best of it for the Reward of EVERY good act in the month of Ramadan is multiplied many times over:

The Prophet (Sallallahu Alaihi Wasallam) said: “Whoever draws near to Allah during it (Ramadan) with a single characteristic from the characteristics of (voluntary) goodness, he is like whoever performs an obligatory act in other times. And whoever performs an obligatory act during it, he is like whoever performed seventy obligatory acts in other times.” (Sahih Ibn Khuzaymah, no. 1887)

If there was a 75% sale on in the shops surely people would go crazy and even cue all night outside in order to be the first in the store to take advantage of this special offer. So in the same way why should we not take advantage of the immense rewards that are available in Ramadan?

The best way we can make the best of this Ramadan and grab the immense rewards that are available is to prepare for it NOW.

The following are 10 ways in which we can prepare for this beautiful month starting from NOW:

1. Voluntary Fasts

What better way of preparing ourselves to fast for 30 consecutive days in Ramadan than to fast the voluntary fasts.

Fasting Monday and Thursday:

Abu Hurairah reported that the most the Prophet, (Sallallahu Alaihi Wasalam) would fast would be Monday and Thursday. He was asked about that and he said: “The deeds of people are presented to Allah on every Monday and Thursday. Allah forgives every Muslim except for those who are deserting each other." He says: "leave them for later”. (Ahmad; Hasan)

Another is to fast the white days (13, 14 & 15th of each Islamic month):

Abu Tharr Al-Ghefari said: “The Messenger of Allah (Sallallahu Alaihi Wasallam) said "O Abu Tharr! If you fast three days of every month, then fast the 13th, the 14th and the 15th [these are call the al-ayaam al-beedh, the white days]". (Ahmad, an-Nasaa'i & at-Tirmithi; Sahih)

Therefore we should fast these days in order to prepare for the fasting of Ramadan and even after Ramadan we should continue to do so for fasting will intercede for us on the day of judgement:

Rasulallah (Salallahu Alaihi Wasallam) said: "Fasting and the Qur’an will intercede for the slave on the Day of Resurrection. Fasting will say: “O My Rabb! I prevented him from food and desires, so accept my intercession for him.’ And the Qur’an will say: “I prevented him from sleep during the night, so accept my intercession for him.’ He (Sallallahu `Alaihi Wasallam) said: ‘And they will (be allowed to) intercede.’” (Ahmad, at-Tabarani, Al-Hakim, Sahih)

2. Reciting Qur’an

Allah the exalted says:

“The month of Ramadan is the one in which the Quran was sent down, a guidance for mankind, clear proofs for the guidance, the Criterion; so whoever amongst you witnesses this month, let him fast it." (Surah al-Baqarah 2:185)

Ramadan was the month in which the Qur'an was first revealed so it is the month of the Qur'an. We should devote much of this blessed month reciting the Qur'an.

Az-Zuhri used to say upon the coming of Ramadan, “It is only about reciting the Qur’an and feeding the poor.”

Abdur-Raziq said, “When Ramadan came, Sufyan Ath-Thawri would give up all acts of (voluntary) worship and devote himself to the recitation of the Qur’an.”

But for many of us the Qur'an has gathered a lot of dust since the last time we picked it up.

As Ramadan is fast approaching we must blow off the dust and start to build a close relationship with the Qur'an for it will intercede with us on the day of judgement:

"Recite the Holy Qur’an as much as we can for It will come as an intercessor for its reciter’ on the Day of Judgement" (Muslim)

The Recitor will be in the company of Angels:

‘Aa'ishah related that the Prophet (Sallallahu Alaihi Wasallam) said: “Indeed the one who recites the Quran beautifully, smoothly, and precisely, will be in the company of the noble and obedient angels. As for the one who recites with difficulty, stammering or stumbling through its verses, then he will have twice that reward.” (Al-Bukhaari & Muslim)

There are Ten Rewards for Every Letter Recited from the Quran in normal times but in Ramadan these rewards are multiplied:

“Whoever reads a letter from the Book of Allaah, he will have a reward, and this reward will be multiplied by ten. I am not saying that 'Alif, Laam, Meem' (a combination of letters frequently mentioned in the Holy Quran) is a letter, rather I am saying that 'Alif' is a letter, 'Laam' is a letter and 'Meem' is a letter.” (At-Tirmithi)

So what better time for us to get into the habit of reciting the Qur'an than to begin to do so right now. We should recite the Qur'an with its meanings and try to understand and implement it into our daily lives.

We should set ourselves realistic targets for how much we should begin to recite each day for e.g. we will recite 1 or 2 pages a day, half a juz (chapter), or 1 juz etc. We should recite however much we can manage and then build up gradually.

3. Praying Superogatory (Nafil) prayers

In Ramadan every voluntary prayer carries the reward of a Fard prayer in normal times and there is nothing more rewarding than a Fard prayer so one can imagine the immense rewards that are available in Ramadan for every voluntary prayer we pray.

The Prophet (Sallallahu Alaihi Wasallam) said: “Whoever draws near to Allah during it (Ramadan) with a single characteristic from the characteristics of (voluntary) goodness, he is like whoever performs an obligatory act in other times. And whoever performs an obligatory act during it, he is like whoever performed seventy obligatory acts in other times.” (Sahih Ibn Khuzaymah, no. 1887)

In order for us to take advantage of these immense rewards we should start begin now by praying all of the daily Sunnah and Nafil prayers so by the time Ramadan comes we will already be in the habit of praying all of our Sunnah and Nafils and so we cna increase our voluntary prayers even more so during Ramadan. This would be difficult if we were not in the habit of praying Sunnah and Nafil prayers in normal times.

By increasing our voluntary worship we can gain closeness to Allah as well as the company of Rasulallah (Sallallahu Alaihi Wasallam) in Jannah:

Rabi'ah ibn Malik al-Aslami reported that the Prophet (Sallallahu Alaihi Wasallam) said: "Ask (anything)." Rabi'ah said: "I ask of you to be your companion in paradise." The Prophet (Sallallahu ALaihi Wasallam) said: "Or anything else?" Rabi'ah said: "That is it." The Prophet (Sallallahu Alaihi Wasallam) said to him: "Then help me by making many prostrations (i.e., supererogatory prayers)."

4. Making Dua

Many of us do not spend as much time as we should do in Dua. Even if we do we rush our dua and our hearts and minds are not present whilst supplicating to Allah.

Many of us rush our Dua's and our hearts are often not present whilst we are supplicating to Allah. Therefore we lose out on much of the benefits and blessings of Dua. We must give more attention to our Dua's and try to concentrate more and be more sincere in our Dua's imagining Allah watching us supplicate to him. We should humble ourselves making ourselves low and not worthy in front of Allah. We should try to cry if we can and have FULL hope that Allah will accept our Dua's if not in this world then in the hereafter.

Allah Almighty says in the Qur’an: "When my servants ask you concerning me, (tell them) I am indeed close (to them). I listen to the prayer of every suppliant when he calls on me."

The place of Dua is so honourable to Allah that the Prophet (Sallallahu AlaIhi Wasallim) said:

"Nothing is more honourable to Allah the Most High than Du`a." (Sahih al-Jami` no.5268).

It is the most excellent of worship:

He also said: "The most excellent worship is Du’a." (Sahih Al-Jami` no. 1133)

So let us get into the habit of making sincere Dua's from deep within our hearts and let us not be heedless when supplicating to Allah. What better time than now for us to get into the habit of making more intense and sincere Dua's. So by the time Ramadan arrives we would have already got into the habit of making the long, sincere and intense Dua's which will readily be accepted during this blessed month especially whilst we are fasting and in the latter part of the nights during Tahajjud.

It may help to make a list of what we should ask of Allah suring dua's which we can refer to as a reminder as this may help us to make our dua's longer and more sincere covering everything we want to ask of Allah.

5. Sincere Repentance

Ramadan is the month where we can gain mercy and forgiveness from Allah for all of our sins past and present.

We should know that Allah is most merciful and most forgiving and loves to forgive:

Allah says: O son of Adam, if your sins were to reach the clouds of the sky and you would then seek My forgiveness, I would forgive you.

When a person sins and then sincerely turns to Allah for forgiveness, one will find Allah ready to accept his repentance and to forgive him, as this verse indicates: And whoever does a wrong or wrongs himself, but then seeks forgiveness from Allah, he will find Allah forgiving and merciful. (Surat an-Nisaa 4:110)

Allah loves repentance and loves those who turn to him in repentance:

Truly Allah loves those who turn [to Him] in repentance, and He loves those who keep themselves in purity. (Qur'an 2:222)

Therefore we should get into the habit now of repenting to Allah so that in Ramadan we will make the best of repenting to Allah and continue to do so throughout everyday of our lives.

How unfortunate is a person who after the end of Ramadan does not gain any forgiveness of his sins from Allah but ends up piling more sins onto his account.

6. Generosity & Charity

Rasulallah (Sallallahu Alaihi Wasallam) became even more generous in Ramadan than he already was.

Ramadan is a time for generosity and giving. It is a time when we think about those who have less than us as well as thank Allah for everything he has given us. Ramadan is an honourable and blessed month, and the rewards for generosity are multiplied in it.

The Prophet (Sallallahu Alaihi Wassallam) said, “The best charity is that given in Ramadan.” (At-Tirmithi).

Prophet (Sallallahu Alaihi Wassallam) said, “He who feeds a fasting person will gain the same reward as he will, without decreasing from the fasting person’s rewards.” (Ahmad).

Therefore we should get into the habit of giving in charity now so by the time Ramadan arrives we would increase in our generosity, giving to those less fortunate than ourselves. We should give whatever we can afford as Allah looks at our intentions.

Surely in there hereafter we will regret that which we did not spend in the path of Allah.

7. Controlling the tongue

Ramadan is a time where we must control our desires (nafs) aswell as our tongues:

Rasulallah (Sallallahu Alaihi Wasallam) said: “Fasting is not (abstaining) from eating and drinking only, but also from vain speech and foul language. If one of you is being cursed or annoyed, he should say: ‘I am fasting, I am fasting.” (Ibn Khuzaimah, Ibn Hibban)

Therefore we must protect our tongue from vain speech and foul language. Protecting the tongue is preventing it from lying, back-biting, slander, tale-carrying, false speech and other things that have been forbidden in the Qur'an & Sunnah.

Those who control their tongues are of the best of Muslims:

The Prophet (Sallallahu Alaihi Wasallam) was asked: “Which Muslim is best?” He responded, “One who the other Muslims are safe from his tongue and his hand.” (Tirmidhi, #2504)

We must not deceive ourselves into thinking that by the time Ramadan comes we will all of a sudden break a lifetime habit and control our tongues. Again this is another big deception. We must start controlling our tongues now for we cannot for changing lifetime bad habits is not an overnight process.

So how can we begin to control our tongues? This can be done by "THINKING BEFORE SAYING ANYTHING". Not just talking without even thinking what we are going to say.

We must think before we speak and before saying anything we should think whether or not what we are going to say is going to please or displease Allah.

If we doubt that what we are about to say may anger or displease Allah then we should refrain from saying it. If we have nothing good to say then surely it is better NOT to say anything at all. Remember we WILL be accountable for everything we said in our lives so we MUST start taking responsiblity for what comes out of our mouths NOW otherwise we will regret it later when it is too late. Therefore we must get into the habit of "thinking before speaking".

So let us begin to control our tongues now so that by the time Ramadan comes we would have adopted good habits and would have been used to controlling our tongues and refraining from saying anything which may anger or displease Allah.

REMEMBER: If we do not protect our tongues then our fasts will be in vain:

Rasulallah (Sallallahu Alaihi Wasallam) said: “Allah does not need the fast of one who does not abandon false speech or acting according to his false speech.” (Sahih Bukhari)

8. Improving Character & manners

Rasulallah (Sallallahu Alaihi Wasallam) came to perfect the character of man and the best of this Ummah are those wioth the best of characters:

Rasulallah (Sallallahu Alahi Wasallam) used to say: "The best amongst you are those who have the best manners and character.” (al-Bukhari)

Rasulullah (Sallallahu Alaihi Wasallam) said: "There is none heavier in the scales of the Hereafter than good character (Tirmidhi & Abu Dawud).

Rasulallah (Sallallahu Alaihi Wasallam) also said: “The best loved by me and the nearest to me on the seats on the Day of Resurrection are those who have the best manners and conduct amongst you, who are intimate, are on good terms with others and are humble, and the most hated by me and who will be on the furthest seats from me are those who are talkative and arrogant." (Tirmidhi)

Again as with making any big change perfecting our character and manners cannot be done overnight but we must make a start now so that by the time Ramadan comes we would have gained momentum in making the necessery changes to our characters in order for us to be the best of this Ummah and those closest to Allah.

Surely if good character and manners are the heaviest on the scales then can you imagine how much more heavier they will be if we behave with good character and manners during Ramadan?

So let us strive to perfect our manners, character and conduct towards others and know that these good deeds will be of the heaviest on the scales and will enable us to reach the highest ranks of Jannah and the closest to Allah.

9. Moderation in eating

On the authority of Al-Miqdaam ibn Maadiy-Karib who said: I heard the Messenger of Allah saying: "No human ever filled a vessel worse than the stomach. Sufficient for any son of Adam are some morsels to keep his back straight. But if it must be, then one third for his food, one third for his drink and one third for his breath." (Ahmad, At-Tirmidhi, An-Nasaa’I, Ibn Majah )

Ibrahim al-Nakha’i, on of the teachers of Imam Abu Hanifa, may Allah have mercy on them both, mentioned: “The people ruined before you were done in by three characteristics: too much talking, too much eating, and too much sleeping.”

There is no doubt that excessive eating is not only a cause of many diseases but is also a major factor in stopping us from maximising our worship to Allah.

Ash-Shafi’I said: I have not filled myself in sixteen years because filling oneself makes the body heavy, removes clear understanding, induces sleep and makes one weak for worship.

Many of us fast during Ramadan fast during the day and after Iftaar make up for all the food we missed throughout the day by binge eating.

Surely this goes against the very purpose of Ramadan which is to be moderate in eating and to remember those who have less than us. How will we remember the unfortunate when we constantly over eating before and after our fasts?

By controlling what we eat now we will not only benefit our health in the short and long term but moderate eating will make us less heavier and enable us to maximise the amount of worship we do everyday during Ramadan and the rest of our lives.

Al-Hassan Al-Basri: “The test of Adam (AS) was food and it is your test until Qiyamah.

And, it used to be said: Whoever takes control of his stomach gets control of all good deeds.

And: Wisdom does not reside in a full stomach.

One day, Al-Hassan offered some food to his companion who said: I have eaten until I am no longer able to eat. To which Al-Hassan said: Subhaana Allah! Does a Muslim eat until he is no longer able to eat?

10. Implementing Sunnah's into Daily life

Following the Sunnah is a command from Allah:

"Say (O Muhammad to mankind): "If you (really) love Allah, then follow me (i.e. accept Islamic monotheism, follow the Quran and the Sunnah), Allah will love you and forgive you your sins. And Allah is Oft-Forgiving, Most Merciful." (Quran: 3:31)

Surely if we follow the Prophet (Sallallahu Alaihi Wasallam) in every aspect of our lives then everything that we do will become a worship to Allah, even going to the toilet, having a bath, dressing and undressing etc

Reviving the Sunnah into our daily lives:

Prophet (Sallallahu Alaihi Wasallam) said: “Whoever revives an aspect of my Sunnah that is forgotten after my death, he will have a reward equivalent to that of the people who follow him, without it detracting in the least from their reward.” (Tirmidhi)

The best habit we can ever have in our lives is to implement the Sunnah into EVERY aspect of our lives so that our whole life and everything we do during it can become a worship to Allah.

We can do this by gradually learning all of the Sunnah's and dua's of every aspect of our day waking up, leaving and entering the Masjid and house, dressing and undressing etc. So let us get into the habit right now of implementing every Sunnah's into our daily lives so by the time Ramadan comes we can continue to implement Sunnah's and gain even more rewards for them.

May Allah enable us to make the best of this Ramadan and make it a salvation for us in the Hereafter. Ameen

Friday, June 24, 2011

What Should Be Malaysia’s Priority:

The 13th General Election or

Preparing The Economy

For The Final Phase of The Global Tsunami,

Total Financial Meltdown?

By Matthias Chang

In my past postings to this website and my global Red Alerts, I had repeatedly

warned the Barisan Nasional Government not to hold any General Elections in

2011 as I had reasoned as far back as November 2010 that the final phase of the

Global Tsunami would hit us at the earliest by the end of the first quarter.

This has happened as forecasted and now in the last few days the crisis

has deepened to the extent that Central Banks the world over are in panic

mode. The beginning of the 3rd quarter, in July there will be formal

recognition by global creditors that the US has defaulted and the bond

markets will unravel. The US federal debt will eclipse the GDP for the first

time since World War II.

The tipping point will come when China panics. Presently, its leaders are putting

up a brave front. If truth be told, they are making preparations for intensive care

for their own survival.

This time round the crisis will be so devastating that what transpired in

2008/2009 would be considered mild in comparison.

This is common sense. If you are a banker / creditor and your principal borrower

is spending beyond its means, continue to borrow from other creditors to make

up the short fall and its assets mortgaged to secure its indebtedness continue to

depreciate to the extent that its value is less than the loan extended, what would

you do?

Even your threats to use the baseball bat will have no effect. USA is dead meat!

My critics will as usual condemn me as a rumour monger and a perpetual bear.

But where were they in 2006, 2007 and even in 2008 when the crisis was full

blown? They got it wrong. Bank Negara got it wrong. The Treasury got it wrong.

The financial community and financial think tanks got it wrong. So how can you

trust these pundits, these experts?

As the only analyst in Malaysia that got it right at the end of 2006 (and not by

hindsight, as evident by the numerous articles by these so-called experts postcrisis),

my critics have no legs to stand on to criticise me on my detail analysis

and as published in my book, “The Shadow Money-Lenders”.

My most conservative analysis at end of 2006 was that there were toxic assets

(junks, toilet papers) floating in the global shadow financial system to the value of

US$20 trillion. I still hold on to the view that the true value of the toxic assets is

approximately US$40 to US$50 trillion. Be that as it may, these figures are

meaningless to the Joe Six-packs and Main Street. It is beyond their imagination.

The toxic assets are still buried deep in the balance sheet of the Too Big To Fail

Banks, Hedge Funds and other major central banks.

A leading financial journal has estimated that “the world had about 30 trillion USD

in ghost assets” of which half went up in smoke between September 2008 and

March 2009. It is their considered opinion that the balance of this 15 trillion USD

ghost assets will “vanish” between July 2011 and January 2012. What I am trying

to say is that, all these fake assets that have been shoring up the credibility of the

global banks will have to be removed from the balance sheet and marked down

as junk, toilet paper.

This will be messy. Imagine banks’ balance sheets exposed as worthless!

The problem is compounded by the massive debts of the once mighty USA and

that of the United Kingdom and Japan. These three countries will cause more

problems than that of Greece, Spain, Portugal, Ireland and Italy (PIIGS)

combined. The former debts are in the US$ trillions (minimum US$ 20 trillion)

whereas the latter are in the US$ billions.

Food for thought - why would China expose her financial flanks and jeopardise

her exit strategy from moribund dollar assets and massive holdings of US$ toilet

papers when the only viable short-term solution / alternative is the Euro?

QEI, QEII and the inevitable QEIII in whatever form is a recipe for disaster, the

likes of which we have never witnessed before! The dynamite that will blow this

global casino to smithereens will be the trillions of US toilet papers (digital or

otherwise) that have flooded the financial system.

And when 100 or more of the major US cities default in the 2nd half of 2011, there

will be blood and social upheaval on Main Street.

US$ asset holders will suffer massive heart attacks.

Yet, I have not seen any pre-emptive measures taken by the Barisan Nasional

Federal Government and for that matter the Pakatan Rakyat State Governments

to prepare the country for this unprecedented financial upheaval. All are too

occupied to retain and to seize more power.

The country is in a state of delusion.

This is best reflected in the property sector of our economy. There is not one day,

that the major newspapers have not advertised glossy advertisements of new

housing and commercial developments, with link houses being priced over a

RM1 million!

July 2011 when viewed with hindsight in December 2012 will be remembered as

the peak in our property bubble. The leading players will suffer irreparable

financial losses and most would not be able to recover from the devastation.

Although belated attempts have been made to cool the consumer debt market,

especially the credit card market, the problem of consumer debts has been

glossed over and there are no viable solutions in sight. Middle-class civil servants

will be hit the hardest. They have been living beyond their means. The lower end

will also suffer, as they have been seduced to buy the additional car because of

cheap hire-purchase finance. But when the crisis descends upon them and they

cannot keep up with the installments, there will be massive repossessions.

Why is Malaysia in a state of denial? Why have the Federal and State

governments fail to adopt the correct strategy?

It is because they have misdiagnosed the economic and financial trends. The socalled

experts are of the view that we are in the “recovery trend” post the

financial crisis of 2008/2009.

But, the actual trend is that of a secular bear market that will last another decade

with occasional short-term “lifts” i.e. the trend is down and we have not reached

bottom. Anyone who is investing and borrowing for an uptrend will be

slaughtered. Anyone that is preserving his/her wealth (by consolidating and

deleveraging / getting out of the market) will survive, but barely.

Corporations on expansion mode are committing Hara Kiri as their cash flow

expectations will not be realised. They are all highly geared, enticed to borrow

and invest by sophisticated spin. The inevitable bankruptcy will follow with banks

screaming for bailouts as non-performing loans in the US$ billions pile up to the

ceiling, just when the shits hit the fan!

This is the stark reality.

If you need proof, just examine the price trends for Gold. In spite of massive

manipulation by central banks, BIS, IMF and global hedge funds to suppress the

price of gold, it has rebounded time after time and continued to gain strength

from short term lows. Gold will hit US$2,000 in the near future and will explode in

2012.

The Federal Reserve, the Bank of International Settlements (BIS), the IMF, the

World Bank and other central banks will collectively rig the currency and stock

markets to create false rallies but they won’t last and if you get sucked in by this

ploy, whatever remaining assets that you have will be wiped out.

So my message to all Malaysians – don’t be fooled by the political rhetoric and

hype by the politicians. Right now, their agenda is to survive and get re-elected

and continue to ride on the gravy train.

Go out and confront the politicians, be they from the Barisan Nasional or Pakatan

Rakyat. Demand from them answers to your queries and solutions to the coming

financial crisis.

Demand from them why till now they have not addressed the issues raised in this

Red Alert.

Demand from them whether there will be massive bailout of financial institutions

and the bloated and too big to fail corporations.

Demand from them solutions, effective solutions to the impending explosion of

food prices.

Do not be fooled by cheap promises and instant patronage by both sides of the

political divide. At the end of the day, it is about power. Trust me, I know from

experience. For them, the only issue is about power – to retain and grab more

power.

Now is the time when you can leverage your demands. Don’t sell your vote for

crumbs.

Now is not the time for elections. Now is the time when you should demand

pre-emptive actions to secure your future, your children’s future and your

grand-children’s future.

When they have the right answers, then and then only they deserve to be elected

and form the government.

If they don’t listen, kick their ass!

Saturday, June 11, 2011

Canadian Dollar Drops as Crude Oil, Stocks Fall on Economic Slowdown Signs

The loonie, as the currency is known for the image of the aquatic bird on the C$1 coin, also dropped as oil, Canada’s biggest export, and stocks fell.

“Even though the number this morning was a little bit stronger, especially in the full-time component, I don’t think it changes what’s going on as far as everything else,” said David Love, a trader of interest-rate derivatives at Le Groupe Jitney Inc. in Montreal. “All our eyes are on the U.S. and what’s going on in Europe.”

The loonie depreciated 0.7 percent to 97.99 cents versus the U.S. currency at 5 p.m. in Toronto, from 97.30 cents yesterday. One Canadian dollar buys $1.0205.

The Standard & Poor’s 500 Index dropped 1.4 percent after adding 0.7 percent yesterday, its first gain after six consecutive days of losses. Crude oil for July delivery decreased 3 percent to $98.85 a barrel in New York after rising 1.2 percent yesterday.

“Canada’s ties to commodities certainly point to a weaker loonie, despite the stronger employment number this morning,” said Dean Popplewell, an analyst at the online currency-trading firm Oanda Corp. in Toronto.

Cross Trades

Among its most-traded counterparts, the Canadian dollar fell the most against the yen, dropping 0.8 percent. The loonie gained against the euro for a third consecutive day, advancing 0.4 percent to C$1.4059.

The loonie strengthened earlier today after a Statistics Canada report showed the nation’s unemployment rate fell to 7.4 percent last month from 7.6 percent in April.

Employers added 22,300 jobs last month after an increase of 58,300 in April. The median forecast of 27 economists in a Bloomberg News survey was for a gain of 20,000.

“From the economic side, I’m not seeing this as a huge jump, but it definitely is positive,” said C.J. Gavsie, managing director for foreign-exchange sales at Bank of Montreal’s BMO Capital Markets unit in Toronto.

Government bonds rose, pushing the yield on the 10-year benchmark security down three basis points, or 0.03 percentage point, to 3 percent. The 3.25 percent note that expires in June 2021 added 25 cents to C$102.10.

Bank of Canada

The loonie rallied on May 31, when the Bank of Canada added language about a potential increase in borrowing costs for the first time since September, saying it will raise rates “eventually” as the economy recovers.

The target for overnight loans between commercial banks remained at 1 percent, where it has been since September. The U.S., to which Canada ships about 75 percent of its exports, hasn’t changed rates since December 2008.

“The domestic side of the Canadian economy just doesn’t need emergency low interest rates, which is not something you can say with the U.S.,” said David Watt, senior currency strategist at Royal Bank of Canada’s RBC Capital Markets unit in Toronto. “The U.S. is our largest trading partner, and that’s probably one of the reasons why the Bank of Canada hasn’t raised the rates more.”

The loonie fell against the greenback on June 3 after U.S. Labor Department figures showed payrolls increased by 54,000 jobs in May after the addition of 232,000 in the previous month. The U.S. unemployment rate increased to 9.1 percent.

To contact the reporter on this story: Cecile Vannucci in New York at cvannucci1@bloomberg.net

Brent oil trading near $118, US crude stocks head lower

Brent oil trading near $118, US crude stocks head lower

Brent oil prices are trading back near $118 a barrel this morning after yesterday’s OPEC meeting boosted crude futures, whilst US oil stocks fell nearly 5 million barrels last week, adding fuel to high oil prices.

Latest Brent Oil Price

In London, Brent crude oil futures for July 2011 delivery was trading at $118.11, 07.50 GMT this morning on the ICE Futures Exchange after jumping one percent in trading on Wednesday.

In America, domestic crude oil stocks fell by 4.8 million barrels, according to the US EIA (Energy Information Administration) surpassing analysts’ expectations for a modist 300,000 barrel decline.

“What this means is that there will be less spare capacity to handle another unforeseen outage. The market will price in this risk premium, and the way they do that is by speculators coming in and buying it up.” said Tony Nunan, a risk manager with Tokyo based Mitsubishi Corp.

Meanwhile, Wednesday’s OPEC meeting also boosted Brent and WTI oil prices as member countries failed to agree any oil output increase.

Tuesday, June 7, 2011

FOREX: Dollar Posts a Tentative Bounce from Larger Decline as the S&P 500 Threatens Collapse

The economic docket for the opening trading day of the new week was light for the US dollar; but there aren’t many specific indicators that can meaningfully shift the currency’s bearing anyway. Far more important are the larger fundamental themes; and that is exactly what was nudging the greenback Monday. Looking to the Dow Jones FXCM Dollar Index, the currency put in for a modest advance after more progressive declines on the previous Thursday and Friday. The nature of this move is corrective – as was the ‘positive’ performance through the first half of last week following the 2 percent drop that preceded it. What this tells us is the market is not yet ready to get behind the dollar’s recovery whether its counterpart be core currencies (which are still advancing against the dollar), fellow safe havens (also still gaining ground on the greenback) or commodity bloc members (who have weakened recently). Yet, there is reason to believe a bigger shift for the dollar is just beginning.

If we had to identify the most influential, potential fundamental driver for the dollar (for immediate impact as well as durability); it would undoubtedly be a shift in US rates. However, even the interest in the withdrawal of austerity and a slow return to rate hikes for the US traces back to risk appetite trends. A rise in rates moves the dollar up the yield spectrum – not necessarily putting it amongst the high yield group; but certainly removing it from the ideal funding currency category. Perhaps the earliest speculation of what market impact a stimulus withdrawal will have is hitting the capital markets first. Considering the US equities market is most dependent on stimulus at its precarious heights, it is reasonable to assume that investors will look to secure gains and avoid a deep correction in this particular area of the markets first. That said, the S&P 500 put in for a meaningful follow up to this past Friday’s close below an advancing trendline that had defined the market’s advance since QE2 speculation started to carry the market back in September. Now below 1,300, there is a distinct possibility that risk aversion itself is catalyzed and provides an immediate boost to the dollar’s fading safe haven appeal. If that is indeed the case, it would be reasonable to expect the Nikkei 225 to drop below 9,320 and the German DAX Index to drop through 7,000.

If there is a risk aversion move; the impact on the greenback will be quick but ultimately limited. Though the currency is still the world’s largest reserve currency; it does represent the same safe haven currency it was five years ago, one year ago or even six months ago. To sustain an advance, the foundation for a sentiment shift has to trace back to the impact the Fed’s eventual unwinding of stimulus will have global investor sentiment. Dallas Fed President Fisher reminded the market that there was still a hawkish voice amongst the policy ranks; but yields (Treasury and Libor) have yet to reflect a similar belief from the market. As we move closer to the QE2 expiry, this concern will gain more traction.

NEW YORK (MarketWatch) — U.S. stocks extended losses into a fourth straight session Monday, with shares of banks, energy and airline stocks among those hardest hit, as Wall Street fretted about the economy.

The Dow Jones Industrial Average DJI -0.50% ended down 61.3 points, or 0.5%, to 12,089.96, with 23 of its 30 components losing ground. Decliners were led by Bank of America Corp. BAC -3.99% , off 4%, and J.P. Morgan Chase & Co. JPM -2.50% , down 2.5%.

The Standard & Poor’s 500 Index SPX -1.08% declined 13.99 points, or 1.1%, to 1,286.17, its first close below 1,300 since March 23, and break through some key support levels. It’s now more than 5% below its bull-market high reached on April 29, and also has fallen through some other low points.

“The intraday support was really at the February and April intraday lows around 1,293. Traders will be looking for a violation of this support to perhaps trigger some stop-loss selling,” said Marc Pado, U.S. market strategist at Cantor Fitzgerald.

After 1,293, the next target is 1,275, Pado said.

Elliot Spar, market strategist at Stifel Nicolaus & Co., cautioned that “when a well-advertised number is breached on the upside or downside, you always have to be on alert for a potential reversal.

“The market finds a way of humbling the most participants,” he said.

The S&P 500’s energy subsector fell 2.02%, following a drop in oil prices ahead of an OPEC meeting later this week, with crude futures off $1.21 to end at $99.01 a barrel on the New York Mercantile Exchange. Read more about oil prices.

Financial stocks fell 2%, hit by worries about rising capital requirements as the economic outlook dims. Read more on energy stocks and read more on financial stocks.

The Nasdaq Composite Index COMP -1.11% closed down 30.22 points, or 1.1%, at 2,702.56.

Apple Inc. AAPL -0.34% , which accounts for about 7% of the index, slid 1.6%. Chief Executive Steve Jobs made a public appearance in San Francisco during the session to tout a music-streaming service Apple is counting on for growth. But the consumer computing company did not reveal any new hardware products, disappointing some observers. Read more about Apple, Steve Jobs.

For every stock that advanced, four fell on the New York Stock Exchange, where 959.2 million shares traded hands.

Airline stocks also weighed on the market, with shares of AMR Corp. AMR -3.69% and Delta Air Lines DAL -0.43% tumbling more than 3% after an industry group sharply trimmed its profit outlook for 2011, citing disasters in Japan, uncertainty in the Middle East and North Africa and the cost of fuel. Read more about airline sector.

Equities have declined for five consecutive weeks, the longest such slide for the Dow industrials since July 2004.

Kate Gibson is a reporter for MarketWatch, based in New York.

Tuesday, May 31, 2011

Oil rises to near $102 on weaker US dollar

SINGAPORE – Oil prices rose to near $102 a barrel Tuesday in Asia as a weakening U.S. dollar made crude cheaper for investors with other currencies.

Benchmark oil for July delivery was up $1.27 to $101.86 a barrel at late afternoon Singapore time in electronic trading on the New York Mercantile Exchange.

The benchmark contract last settled Friday up 36 cents at $100.59. Markets in the U.S. were closed Monday for the Memorial Day holiday.

In London, Brent crude for July delivery was up $1.04 to $115.72 a barrel on the ICE Futures exchange.

Crude has risen from $96 last week amid a depreciating U.S. currency. The euro rose to $1.4406 on Tuesday from $1.4287 late Monday.

"Bottom line, as goes the dollar, so goes oil, in the opposite direction," energy consultant The Schork Group said in a report.

Traders are also eyeing the U.S. economy, where recent manufacturing and consumer spending indicators have been less than robust.

However, sluggish economic indicators are a mixed signal for oil traders. A weaker economy would suggest less demand for crude, but it also tends to reduce confidence in the dollar, and a falling U.S. currency usually boosts oil prices.

"The strength and sustainability of the U.S. recovery is in question," The Schork Group said. "But the Catch-22 is poor economic headlines are actually supporting higher oil prices vis-a-vis the U.S. dollar."

Oil has dropped from a 30-month high near $115 a barrel on May 2.

In other Nymex trading in June contracts, heating oil gained 2.3 cents to $3.01 a gallon and gasoline added 2.7 cents at $3.12 a gallon. Natural gas futures rose 7.7 cents to $4.60 per 1,000 cubic feet.

Monday, May 30, 2011

Have Gold Prices Stopped Falling? - 27 May 2011

WE'VE SEEN Gold Prices fall from $1,578 to $1,492 in recent weeks – a 5.45% drop. Gold Prices in the Euro it fell from €1,065 to €1,042 – a fall of 2.16%. The fall of gold in the Euro painted a more accurate reflection of supply and demand, because the Dollar rose against the Euro, as gold was falling, reckons Julian Phillips at GoldForecaster.

This was simply a correction, provided the Gold Price has stopped falling now. A fall of 10% is a proper correction and a mid-trend correction fall should be around 20 to 30%.

The fall appears to have been caused by a big investor and his following virtually dumping around 37 tonnes in a two week period into a market that is used to seeing around 6 tonnes a day from the producers.

Pity he didn't have a better dealer. This seller appears to have completed his sales (if it was George Soros, then he has completed them, for he only held 30 tonnes apart from gold shares).

The fall from just about $50 to $32 rattled the entire market. After all, a fall of 36% is a major trend correction were it broad based from many investors over a period.

But this drop was again due to awful dealing with 1,000 tonnes from the Silver Trust's holdings coming onto the market over two weeks, with the bulk dumped into the market in the second week together with another 7 tonnes from similar thinkers.

With the Silver Price back above $37 the drop is now down to a fall of 26% from the peak of $50. Again the selling has largely stopped with two-way traffic now in play.

The gold market is a global, well centralized market based in London, where heavy sellers and buyers are brought together quickly and a well-priced deal made that cuts out the bulk of the volatility we see in the silver market.

The London Fix is where potential buyers and sellers of physical gold sit on the end of their telephones twice a day and see what's on offer and what the bids are for it. Even the appearance of a large amount such as we saw from the States is swallowed up quickly and in an orderly fashion.

The value of an ounce of gold at 41 times the price of an ounce of silver increases the liquidity for the big players in the market, making it easier to move large amounts quickly.

Silver has nowhere near that level of liquidity or depth of investors. The type of investor is wide from institutions to industry from the small investor to the large one and a fully global market at that.

However, the day-to-day dealings, while well-organized, are not sufficiently large in two-way traffic to accommodate the sudden appearance of 1,000 tonnes in two weeks. This is why the market is so volatile and swings so widely, compared to the gold market.

The silver market will, over time, see a lessening of volatility once prices are higher and silver more accepted as a precious metal more closely linked to gold. We would then expect to see Silver Prices move far closer to those of gold.

Bearing in mind that the fundamentals for silver's traditional uses and industrial applications are either for investment, jewelry or much needed applications in industry, the fundamentals for silver are just as they were while the Silver Price was rising and are unlikely to change. These users will be delighted with any pullback, but tend to be price-insensitive.

That means they need silver no matter what the price. As to the investment demand for silver, this is at its largest from the emerging world and is likewise relatively price-insensitive. People from this part of the world are buying in line with their increasing income and ability to buy. The price rises have simply confirmed the wisdom of such a policy.

The same applies to the gold market, but with the added feature that central banks are buyers as well. These too are price-insensitive buyers, simply taking up gold as it appears on the market, without chasing prices.

The prices of both gold and silver have risen from their recent bottoms and have begun to rise. This is a classic 'floor' finding exercise.

Silver has been the slower mover and has waited for gold to lead the way. In the Dollar the Silver Price is recovering and is now moving through the $37 level. In the Dollar the Gold Price still has another $50 to rise to its peak levels too. This is another 3% more. Silver at $37 still has to rise another 26% to reach its peak.

But what is hiding their moves has been the rally in the Dollar itself. In the Euro silver fell from €33.56 to €22.53 a fall of 33%. It now stands at €26.3 a fall of 21.6%. This shows it is recovering faster in percentage terms, once we extract the Dollar gyrations.

It is clear then that support is now effective and holding up both the prices of gold and silver in the market. Especially if we look at the Euro Gold Price – which set a new record high this week.

Thursday, May 26, 2011

Dollar Rebound Hinted as Stock Positioning Points to Collapse in Risk Appetite

US DOLLAR INDEX – The greenback is testing trend-defining support at a rising trend line set from the record low in March 2008, with a break lower amounting to a material bearish shift in long-term positioning. Likewise, the boundary is a logical place for a reversal higher and the currency’s behavior here over the coming days and weeks will be critical in determining where the benchmark unit (and the major currencies in general) are heading.

MSCI WORLD STOCK INDEX – Prices are testing a critical support level at the confluence of two significant trend lines – a longer-term one set from August and a minor one dating back to December – as well as 23.6% Fibonacci retracement of the rally from the late-November swing bottom. Negative RSI divergence hints the path of least resistance favors the downside, suggesting a major collapse in market-wide risk appetite may be just around the corner.

CRUDE OIL – Prices spiked higher but overall positioning remains little changed, with crude trapped between the 161.8% Fibonacci extension of the downswing from late January 2010 ($98.40) and a rising trend line connecting major highs since June (now at $95.53). Renewed upward momentum targets the 200% Fib at $101.83 while a break back below the trend line exposes $92.84.

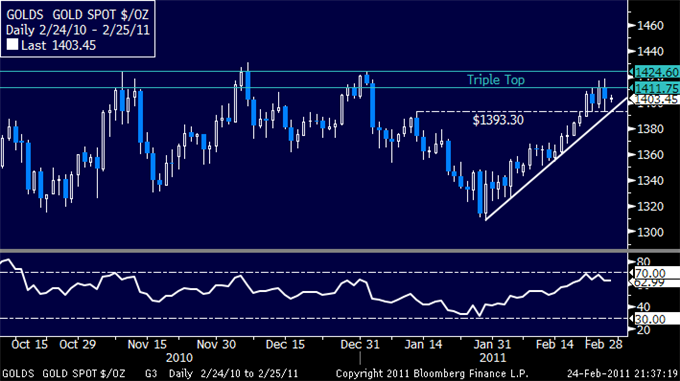

GOLD –Prices continue to consolidate below triple top resistance in the $1411.75-1424.60 region. Negative RSI divergence hints at the likelihood of a downside scenario. Initial support lining up at $1393.30 (the Jan 13 high) and is reinforced by a rising trend line set from the January low. Penetration below this barrier initially exposes $1376.20.

For real time news and analysis, please visit http://www.dailyfx.com/real_time_news

To receive future articles by email, please contact Ilya at ispivak@dailyfx.com

Tuesday, May 24, 2011

THE RINGGIT AND THE DOLLAR

by Dr. Mahathir bin Mohamad on Thursday, 12 May 2011 at 06:56

1. The dollar i.e. the US dollar has been depreciating against the Ringgit. It is now hovering just below RM3.00 to 1 USD. Obviously this currency crisis is not over yet. Obviously the US is still in trouble. Europe is also in trouble and so is the rest of the world. This is the longest financial crisis in history. It is now in the fourth year.

2. This crisis started in the US in 2008 with the banks going bankrupt because the sub-prime loans defaulted and Lehman Brothers went bankrupt. Since then the US Government has been printing money by the trillions to bail out banks, insurance and automobile companies.

3. Currently Greece is still unable to repay loans caused by the switch to the Euro.

4. Malaysia appears to have escaped much of the crisis. Our currency is in fact getting stronger and our economy is growing at a good rate.

5. Why has a serious currency crisis affected the developed countries and not as much the developing countries? The answer is that we have not been trying to get rich quick through playing the money market.

6. I am not a financier of course and my knowledge about finance can be written on the back of a postage stamp. So no one should take what I say about finance seriously.

7. Still, I would like to hazard a theory.

8. The US was, after the Second World War, the richest nation. They have companies like General Motors, General Electric, Caterpillar Tractors, McDonnell Douglas & Boeing, great manufacturers of household appliances, radios and television, machine tools, precision instruments and of course a massive weapons industry.

9. They were so confident of the superiority of their industries that they did not mind teaching the Japanese the importance of quality and expertise in manufacturing.

10. To cut a long story short, the Japanese mastered manufacturing so well that their high quality but competitive products displaced those of the Americans and much of the Europeans in the world market.

11. After Japan came Taiwan, South Korea and then China. The products of these countries even displaced American and European products in their own countries. The last straw is the invasion of East-Asian cars into the American and European markets.

12. Instead of trying to compete, the Americans in particular, and the Europeans opted to surrender the markets to the Asian newcomers. But American and European economies continued to grow and they remain as prosperous as ever.

13. To remain ahead in wealth the Americans and Europeans invented a new market - the money market. They invented ways of making money from money. These they call products although they cannot be eaten or used.

14. The banking system they created was for the purpose of lending money to finance business enterprises. To do this the banks were allowed to lend more money than they have as capital, assets and deposits. In effect this means the banks could create money. In fact in the past banks issued banknotes to pay for goods and services. Later the banknotes were replaced by cheques. Everything can be paid with cheques. No cash is needed any more.

15. It was fine as long as the Government oversees the money created by the banks and limits it to ten times the banks assets. Then the American Government decided that it should not supervise the banks. The market would regulate itself.

16. Freed of Government oversight the banks began to lend far more than ten times their assets. They lent even to people with no income and no capacity to repay the loans, especially for houses.

17. The loans were then either mortgaged or insured. The belief was that they were safe. In any case if the borrower defaulted the property would be worth more than the loans as property prices seem to appreciate all the time.

18. Other ways of making money were invented. Hedge funds, carry trade, currency trade, mergers and acquisitions, investment in 'emerging markets' (formerly known as developing countries), junk bonds, securitised mortgage, commercial paper, short selling, index funds, sub-prime loans, private equity funds, repo market, structured investment vehicles, etc etc

19. Any of these things can give huge profits. For the astute players any of these things can make them millionaires or billionaires overnight, practically overnight.

20. The money market products yield nothing substantial. They create no jobs, no tangible products, no trade in goods or services, no spin-offs in terms of business, no transportation of goods by land, sea or air.

21. Yet the size of the transactions in monetary terms is mind-boggling. The trade in currencies is said to amount to four (4) trillion US dollars a day. It is the size of the total German productivity for a year. Yet no jobs are created, no goods or services are produced, no movement of anything is seen.

22. Of course the people involved in the trade make billions of dollars. Operating out of tax free havens, they report to no one and pay no tax.

23. The money market players and the billions they make contribute to the high GDP and the Per Capita incomes of America and Europe.

24. Then came the collapse. The bubble bursts. And there was nothing spilling from the burst bubbles.

25. The money market players know nothing about other business, about the production of goods and service, about real trade in these things. Actually all of them have become poor.

26. And so they resort to printing money, to remain rich. But the money they print is as valuable as toilet paper.

Monday, May 23, 2011

dave stacy

Dave, a staunch Christian from West Virginia, lived in a Muslim community in Dearborn, Michigan, for 30 days.

Before going to live with Shamael and Sadia, Dave had scant interaction with any Muslims. "I picture a woman with a sheet or hat and her face covered," he said. "I think of men with AK-47s." But Dave knew stepping out of his comfort zone was an amazing opportunity. "It's going to put me, probably, in one of the most vulnerable positions I have to be in," Dave explained, "and I expect to really grow from it."

But the cultural discomfort cut both ways: Shamael was uncomfortable with the prospect of Dave's being alone with Sadia. As Shamael explains, "It's just more of a religious custom that one doesn't stay in a room alone with another person from the other sex."

Dave did stay for the full 30 days and began to embrace Muslim culture. He wore traditional Muslim clothing, studied the Koran daily, spoke Arabic, grew a beard and ate Middle Eastern food.

At the end of his 30-day dare, Dave had a much different perspective about Islam. "Before, I never really knew anything about Islam and I really never had any thoughts of it. I got married, actually, on September 15, four days after 9/11. I just was so angry right after that event!" Dave admits. "It's a very shallow view: 'Muslims hate us. We hate them. Why don't we just nuke them?' There's never really any thought past that. Unfortunately, people that are so ignorant of the other faiths are often the ones that are most vocal about it."

Now, after essentially becoming a Muslim for 30 days, Dave has a new understanding of prejudice. "I've got a new appreciation for what it's like to be discriminated against," says Dave. "When I was in Michigan, it was strange because the white Americans there looked at me very differently [when I was dressed like a Muslim,] often with very mean looks on their faces. [Meanwhile,] the Muslim population was very, very distrustful of me. They thought I was part of some conspiracy to make them look bad."

Of course, this was an interesting experience for Dave's hosts as well.

Shamael says that he found it difficult when he informed Dave of the rules preventing unmarried men and women from being alone together. "As a host, we should be welcoming and we should be inviting— it doesn't matter who it is," explains Shamael. "But with the religious and cultural upbringing we have, we felt it was the appropriate thing to tell him. 'Okay, the man has to go or the woman has to go.' Men and women just don't stay together in one room alone."

In another eye-opening experience, Shamael recounts a conversation he had with Dave. "I asked him a question. I said, 'Name five Muslims that you know,'" Shamael says. "He told me, 'Osama bin Laden, Saddam Hussein...' And I'm, like, 'Oh, my God: We're all terrorists.' And I said, 'What about Muhammad Ali? What about Hakeem Olajiwan? What about these more prominent Muslim figures in America?' And I realized, at that point, Muslims need to do a better job about explaining their faith, about being better American citizens, about taking the lead in addressing different social issues and whatnot."

Saturday, May 21, 2011

Zimbabwe To Trade Diamonds For Gold As It Prepares To Launch Gold-Backed Currency

Hyperinflation

International Monetary Fund

Reserve Currency

World Bank

A week ago we presented the idea floated by once hyperinflationary Zimbabwe, oddly jeered by most, that the country is seeking to move to a gold-backed currency, adding, somewhat surrealistically, that the "days of the US dollar as the world's reserve currency are numbered." And if anyone should know a hyperinflationary basket case, it's Zimbabwe. Well, today this bizarre story just went fuller retard, after the country announced that it may exchange diamonds for gold "so that it can have a gold-backed currency, according to a recent proposal from the governor of Zimbabwe’s central bank." Indeed we speculated previously why: "Zimbabwe, a country rich in natural resources, took so long to figure out that it was nothing but a puppet in the hands of western monetary interests." Well, others are now getting this idea - Commodity Online reports that "The country is a resource hub: It sits on gold reserves worth trillions. It has the world’s second largest reserves of platinum, has got alluvial diamonds that can fetch the nation $2 billion annually and even boasts of chrome and coal deposits." And since Zimbabwe is now fully on board this whole "pioneering" thing perhaps it should just go ahead and create the first diamond-platinum backed currency. Just don't give China and Russia ideas about floating a new reserve currency that actually has real commodity backing. What's that, you say? They are launching one soon? Oh well.

From Commodity Online:

The Zimbabwean dollar is no longer in active use after it was officially suspended by the government due to hyperinflation. The United States dollar, South African rand, Botswanan pula, Pound sterling, and Euro are now used instead. The US dollar has been adopted as the official currency for all government transactions with the new power-sharing regime, says Wikipedia.

But the central bank of Zimbabwe—Reserve Bank of Zimbabwe (RBZ)—believes that the US dollar is no longer stable.

According to Dr Gideon Gono, RBZ Chief, the inflationary effects of United States’ deficit financing of its budget may impact foreign countries and would lead to a resistance of the green back as a base currency; cited newzimbabwe.com.

Writing in a blog in New Zimbabwe, Gilbert Muponda, an entrepreneur based out of Zimbabwe has welcomed the proposal of a gold-backed Zimbabwean currency. He has applauded the proposal of the central bank governor to sell diamonds for gold.

On the other hand, for the country to move to some semblance of a gold standard, it may wish to consider shifting form a despotic dictatorship controlled by Robert Mugabe to something a little less "centrally planned."

The government’s protectionist measures have kept the mining companies at bay. The government wants the foreign miners to sell controlling stake in ventures to local blacks, which is obviously frowned up on by all. The companies, given the uncertain situation, have refrained from investing further in expansion activities in Zimbabwe.

The country cannot access foreign credit as the ZIDERA Act passed by the United States in 2001 blocks US entities from trading with certain Zimbabwean institutions and individuals This has forced the US representatives in lending agencies like World Bank, IMF, IFC, and ADB to take a favorable stance when it comes to Zimbabwean credit requests.

That said, where there's a will there's a way. And since this story refuses to go away, it probably means that Zimbabwe will definitely give it the old college try. Once again, the question is not what happens in Zimbabwe, but elsewhere, should the experiment prove to be even remotely successful.

Thursday, May 19, 2011

FOREX: Japan Enters Recession, NZ Dollar Gains on Budget Surplus Outlook

CCY | SUPPORT | RESISTANCE |

| EURUSD | 1.4084 | 1.4330 |

| GBPUSD | 1.6016 | 1.6274 |

The Euro was little changed in overnight trade, rising to test above 1.43 to the US Dollar in the first part of the session as Asian stocks followed Wall Street higher to weigh on safety-linked demand for the greenback but promptly erasing the advance as shares reversed course in the aftermath of Japan’s GDP figures (see below). The British Pound mirrored the single currency, rising toward the 1.62 figure but failing to hold ground ahead of the opening bell in Europe. We are looking for EURUSD and GBPUSD selling opportunities and remain long USDJPY.

Asia Session: What Happened

GMT | CCY | EVENT | ACT | EXP | PREV |

| 23:01 | GBP | Nationwide Consumer Confidence (APR) | 43 | 46 | 45 (R+) |

| 23:50 | JPY | Gross Domestic Product (QoQ) (1Q) | -0.9% | -0.5% | -0.8% (R-) |

| 23:50 | JPY | Gross Domestic Product Annualized (1Q) | -3.7% | -1.9% | -3.0% (R-) |

| 23:50 | JPY | Gross Domestic Product Deflator (YoY) (1Q) | -1.9% | -1.8% | -1.6% |

| 23:50 | JPY | Nominal Gross Domestic Product (QoQ) (1Q) | -1.3% | -0.7% | -1.1% (R-) |

| 23:50 | JPY | Housing Loans (YoY) (1Q) | 2.7% | - | 3.2% |

| 1:00 | AUD | Consumer Inflation Expectation (MAY) | 3.3% | - | 3.5% |

| 1:30 | AUD | Average Weekly Wages (QoQ) (FEB) | 1.0% | 1.2% | 1.4% (R+) |

| 1:30 | AUD | Average Weekly Wages (YoY) (FEB) | 3.8% | 3.8% | 3.9% |

| 2:00 | NZD | New Zealand Releases Annual Budget | - | - | - |

| 4:30 | JPY | Industrial Production (MoM) (MAR F) | -15.5% | - | -15.3% |

| 4:30 | JPY | Industrial Production (YoY) (MAR F) | -13.1% | - | -12.9% |

| 4:30 | JPY | Capacity Utilization (MoM) (MAR) | -21.5% | - | 2.9% |

| 5:30 | JPY | Nationwide Department Store Sales (YoY) (APR) | -1.5% | - | -14.7% |

| 5:30 | JPY | Tokyo Department Store Sales (YoY) (APR) | -5.5% | - | -21.5% |

Currency markets were relatively quiet in overnight trade, with the New Zealand Dollar outperforming after the Finance Minister Bill English said in the annual Budget that the government will return to surplus by June 2015, easing sovereign debt fears that have plagued the island nation, prompting ratings agencies Standard and Poor’s and Fitch to put to downgrade their credit outlooks to “negative” in November 2010 and July 2009, respectively. The currency rose as much as 0.9 percent against its top counterparts.

Japanese Gross Domestic Product figures showed the country entered into recession as the economy shrank 0.9 percent I the first quarter having slumped 0.8 percent in the three months through December 2010. The outcome had little immediate impact on the Japanese Yen despite the worse-than-expected outcome considering a generally dismal print was widely expected considering the island nation suffered its worst earthquake on record during the period in question. The disaster took a heavy toll on economic activity, shuttering businesses and disrupting export deliveries. Still, the currency would go on to underperform as bearish momentum built throughout the session.

Euro Session: What to Expect

GMT | CCY | EVENT | EXP | PREV | IMPACT |

| 8:30 | GBP | Retail Sales ex Auto Fuel (MoM) (APR) | 0.8% | 0.2% | Medium |

| 8:30 | GBP | Retail Sales ex Auto Fuel (YoY) (APR) | 2.2% | 0.9% | Medium |

| 8:30 | GBP | Retail Sales inc Auto Fuel (MoM) (APR) | 0.8% | 0.2% | Medium |

| 8:30 | GBP | Retail Sales inc Auto Fuel (YoY) (APR) | 2.5% | 1.3% | Medium |

| 9:00 | EUR | Italian Current Account (€) (MAR) | - | -6337M | Low |

| 9:00 | CHF | ZEW Survey (Expectations) (MAY) | - | 8.8 | Low |

| 10:00 | GBP | CBI Trends Selling Prices (MAY) | - | 36 | Low |

| 10:00 | GBP | CBI Trends Total Orders (MAY) | -9 | -11 | Low |

UK Retail Sales headline the calendar in European hours, with expectations calling for core receipts (excluding auto fuel) to rise 2.2 percent in the year through April, marking the strongest outcome in three months. While encouraging, the release is unlikely to prove particularly supportive for the British Pound.

Echoing concerns raised in an analogous release from the BRC, an outsized year-on-year increase this time around seems to substantially owe to a particularly weak result in April 2010, where retail conditions were marred by uncertainty ahead of the UK general election and which didn’t include Easter holiday spending, as this year’s numbers will. An unexpected drop in the Nationwide Consumer Confidence gauge reported overnight will do little to stem skepticism.

Sizing up sentiment trends, stock index futures tracking key European bourses are well into positive territory ahead of the opening bell, but this likely follows the corrective bounce on Wall Street rather than a genuine reversal of recent weakness. Indeed, as noted in our weekly fundamental trends monitor, “markets don’t move in straight lines and some fits and starts [are] to be expected” as the emerging risk-averse trend centered on the unwinding of bets dependent on cheap QE2 funding ahead of the program’s June expiry runs into short-term bargain hunters.

Meanwhile, futures tracking the S&P 500 are essentially flat, pointing to indecision after the rebound heading into yesterday’s FOMC minutes release. With that outcome proving to be largely a non-event as expected, the larger risk-negative trend established over the past two weeks looks ready to resume, giving the US Dollar scope to resume its advance against the major currencies.

For real time news and analysis, please visit http://www.dailyfx.com/real_time_news